TrippaTrading AI EA MT4 V5.3 with Setfiles

$1,200.00 Original price was: $1,200.00.$39.99Current price is: $39.99.

TrippaTrading AI EA MT4 combines Bollinger Bands signals with intelligent grid management. Verified $4,148+ profits from live accounts. MT4 compatible.

TrippaTrading AI EA Introduction

TrippaTrading AI EA stands out through its intelligent combination of Bollinger Bands mean-reversion signals with adaptive grid management and precise indicator-based closing mechanisms. The system has generated verified profits across multiple live accounts, including a $4,148.95 combined return from EURNZD and USDCAD trading within days.

Key Findings

• Dual-Signal Architecture: Utilizes Bollinger Bands extremes for entry timing combined with central band reversions for exit signals, creating a complete mean-reversion framework with built-in profit protection

• Intelligent Grid Management: Implements distance-controlled grid placement with configurable lot sizing and multiple compliance filters to manage position scaling during market reversals

• Multi-Layer Protection: Features monetary limits, percentage stops, spread filtering, time restrictions, and Friday closure options to address various risk scenarios in automated trading

• Live Performance Data: Demonstrates consistent profitability with AUDCAD showing 21.95% growth ($1,000 to $1,219.52) and individual trades reaching $282.72 profit, though drawdowns can reach -$253.50 per position

• Strategy Limitations: Optimized for sideways markets with potential vulnerability during strong breakouts or sustained trending conditions requiring active market assessment

TrippaTrading AI EA Recommended Setup

• Trading Platform: MetaTrader 4 (MT4) exclusively – not compatible with MT5

• Currency Pairs: GBPUSD, EURUSD, AUDCAD, EURNZD, USDCAD, NZDJPY – prioritize pairs with historical ranging behavior

• Account Types: Standard and ECN accounts supported – verify grid trading compatibility with broker

• Timeframe: Universal timeframe support – EA adapts to active chart period

• Trading Schedule: Monday-Thursday operation recommended – built-in Friday restrictions available

• Leverage: 1:200 to 1:400 optimal – excessive leverage amplifies grid position risks significantly

• Capital Requirements: $1,000 minimum deposit – larger accounts handle grid drawdowns more effectively

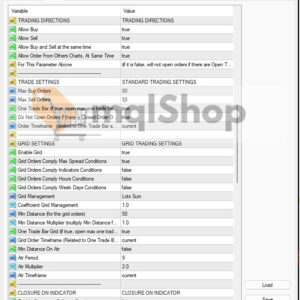

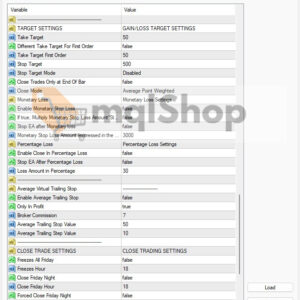

Quick-Start Parameter Guide

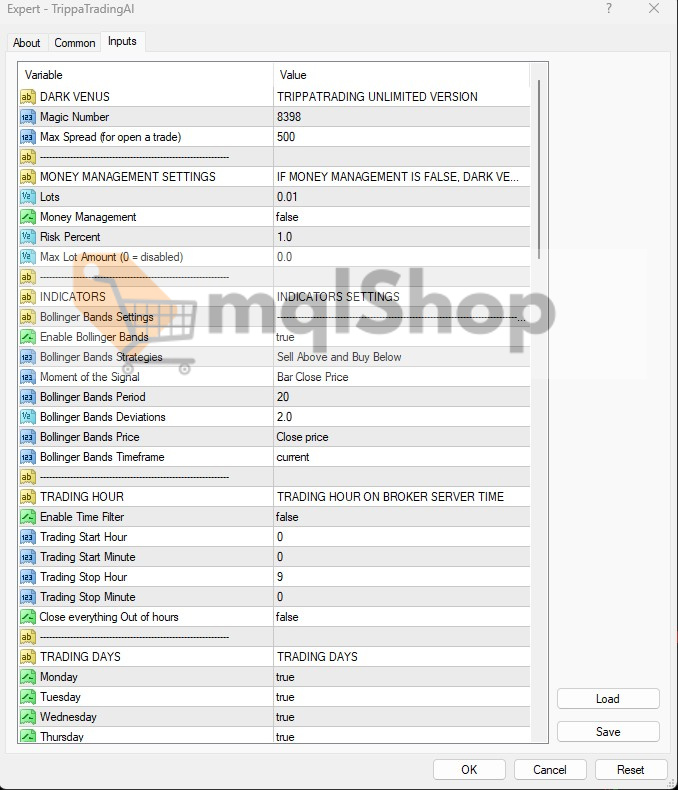

Core Strategy Settings

• Bollinger Period (20): Standard deviation calculation timeframe

• Deviations (2.0): Band width control – affects signal frequency and accuracy

• Strategy Type (Sell Above/Buy Below): Core mean-reversion approach

• Signal Timing (Bar Close): Confirms signals at bar completion

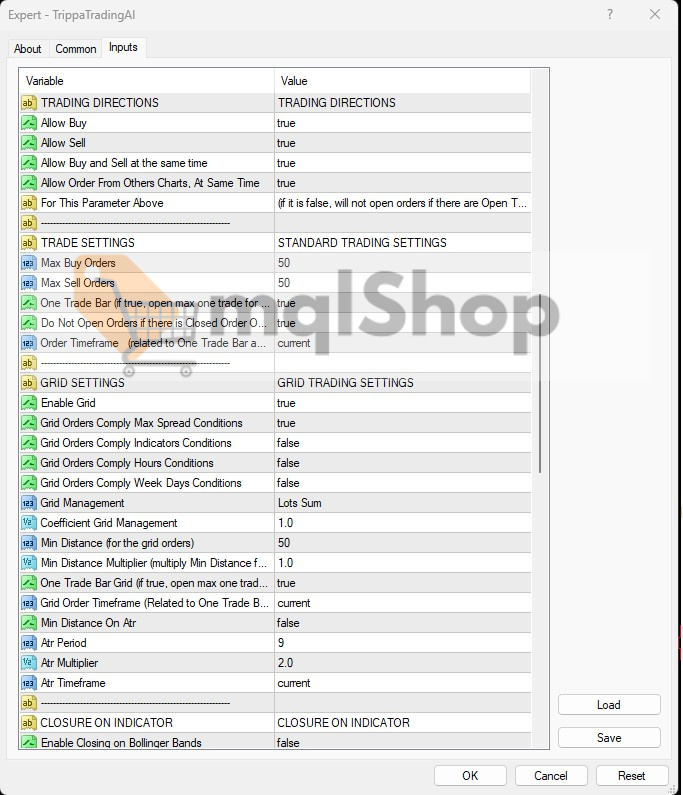

Position Management

• Fixed Lots (0.01): Base position size for initial entries

• Money Management Toggle: Enables risk-percentage based sizing

• Max Orders (50 each direction): Prevents excessive grid accumulation

• Grid Distance (50 points): Minimum spacing between grid levels – critical for risk control

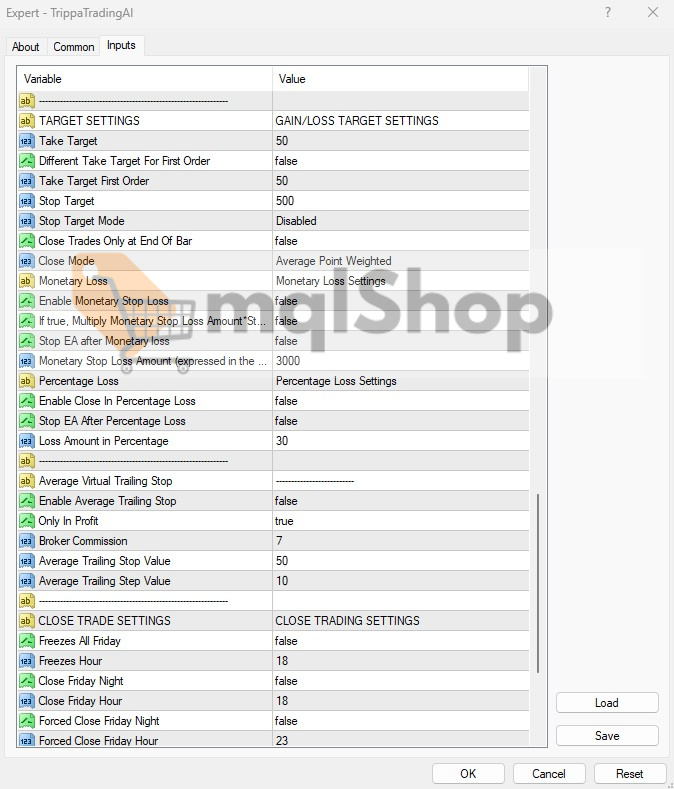

Risk Controls

• Stop Target (500): Maximum loss per position in points

• Monetary Stop Loss: Account-level loss limit in account currency

• Percentage Loss (30%): Alternative account protection method

• Max Spread (500): Entry filter for volatile conditions

Timing Filters

• Day Selection: Monday-Thursday default operation

• Hour Restrictions: Customizable trading windows

• Friday Settings: Automatic closure and freeze options

Review of TrippaTrading AI EA

This EA provides disciplined mean-reversion trading with impressive live results, but requires understanding of grid risks and market condition suitability. The comprehensive parameter set offers flexibility while maintaining systematic risk management throughout operation.

Performance Snapshots:

• Multi-account success: $5,653.96 balance achieved from $2,157.57 initial deposit

• Consistent daily gains: $1,434.69 and $1,097.37 on consecutive trading days

• Trade range efficiency: Profits from $1.18 to $18.74 per individual position

• Risk exposure: Grid positions can accumulate during adverse price movements

Is TrippaTrading AI EA the Right Choice For You?

• Systematic Mean-Reversion Approach: Provides clear entry/exit rules based on statistical price behavior, though effectiveness diminishes during market regime changes to strong trending conditions

• Advanced Grid Intelligence: Offers sophisticated position scaling with multiple safety controls, but users must maintain adequate capital reserves for potential drawdown periods

• Documented Live Performance: Shows real trading profits across multiple accounts and currency pairs, providing transparency often missing from backtest-only EA presentations

• Complete Automation Package: Eliminates manual monitoring and emotional interference while handling complex multi-position scenarios, requiring initial setup knowledge but minimal ongoing intervention

• Risk-Aware Design: Incorporates multiple protection mechanisms and market timing filters, though grid trading inherently carries compound risk during sustained adverse movements

Final Verdict

TrippaTrading AI EA delivers sophisticated mean-reversion automation with verified profitability and comprehensive risk management. Ideal for systematic traders comfortable with grid strategies seeking consistent ranging market performance.

TrippaTrading AI EA MT4 Download Contents:

- Link download experts:

- TrippaTrading AI EA MT4 .ex4

- Presets:

- SettingsB1000.set

Be the first to review “TrippaTrading AI EA MT4 V5.3 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

SOURCE CODE

Reviews

There are no reviews yet.