Blue Xpert Prime EA +3.0 MT5 (original)

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

Blue Xpert Prime EA MT5: Conservative forex robot with single-trade safety, 1:2 risk-reward ratio. No grid/martingale risks. Capital preservation focus.

Blue Xpert Prime EA MT5 Introduction

Blue Xpert Prime EA MT5 stands out as a conservative automated trading solution designed for traders prioritizing capital preservation over aggressive growth. The EA demonstrates a profit factor of 21.78-23.70 in backtests with maximum equity drawdown of just 0.39%-2.26%. Built with a strict single-trade limit and fixed risk-reward parameters, it eliminates the dangerous martingale and grid strategies that destroy most automated trading accounts.

Key Findings

• Conservative Single-Position Strategy: Uses one trade at a time with fixed 500-pip stop loss and 1000-pip take profit, creating a disciplined 1:2 risk-reward ratio that prevents overexposure and catastrophic losses common with grid/martingale systems

• Core Trading Logic: Operates on EURUSD M5 timeframe using low-frequency signal generation, focusing on capturing larger market moves rather than scalping – the wide stop-loss parameters allow positions breathing room while the high risk-reward ratio compensates for lower win rates

• Extreme Risk Management: Fixed lot sizing (0.01 default) combined with mandatory stop-loss on every trade creates predictable risk exposure – approximately $50 maximum loss per trade on standard accounts, making it suitable for conservative portfolio management

• Backtest Performance: Shows impressive profit factors of 21.78-23.70 with equity drawdowns below 2.26%, however critical limitation: 46% history quality severely undermines reliability of specific profit figures, requiring live verification before deployment

• Capital Protection Focus: Designed for patient traders seeking steady growth over quick profits – the anti-martingale design prevents account blowouts but requires realistic expectations of lower trade frequency and gradual accumulation

Blue Xpert Prime EA MT5 Recommended Setup

• Trading Platform: MetaTrader 5 (MT5) only

• Currency Pair: EURUSD exclusively – optimized specifically for this major pair’s characteristics

• Timeframe: M5 (5-minute) – essential for signal accuracy

• Account Type: ECN or Standard accounts supported – ensure tight spreads for optimal performance

• Leverage: 1:100 minimum recommended – higher leverage amplifies both potential profits and losses, understand risk implications

• Minimum Deposit: $100 minimum – higher balance ($500+) advisable for better risk distribution and psychological comfort with 500-pip stop losses

• Trading Hours: 24/5 automated operation – no specific session restrictions

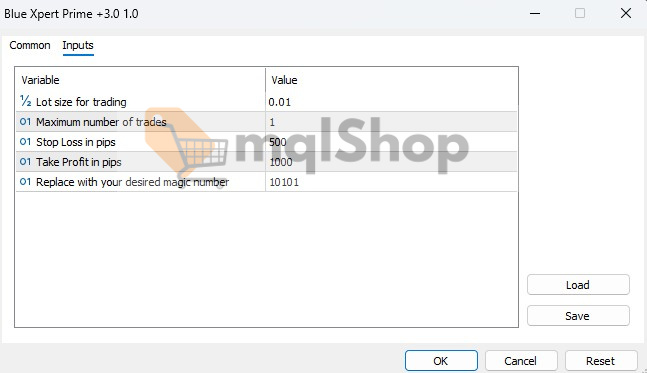

Quick-Start Parameter Guide

Risk Management Parameters

• Lot size for trading (0.01): Controls position size and dollar risk per trade – maintain conservative sizing to align with 500-pip stop loss

• Maximum number of trades (1): Core safety feature preventing dangerous multiple position exposure

• Stop Loss in pips (500): Fixed exit level protecting capital – wide setting prevents premature stops but requires proper position sizing

Trade Execution Settings

• Take Profit in pips (1000): Target profit level maintaining 1:2 risk-reward ratio

• Magic number (10101): Unique identifier for EA trades – customize if running multiple EAs

Critical Risk Note: Never increase lot size beyond account capacity to handle 500-pip losses comfortably.

Review of Blue Xpert Prime EA MT5

Blue Xpert Prime EA MT5 offers a refreshingly conservative approach to automated trading, prioritizing capital preservation through single-position limits and fixed risk parameters, though traders must verify performance beyond the unreliable 46% quality backtests.

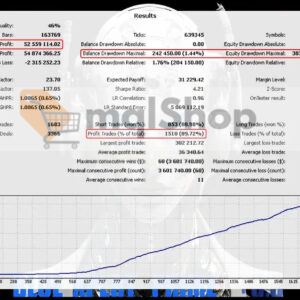

Backtest Performance Snapshots:

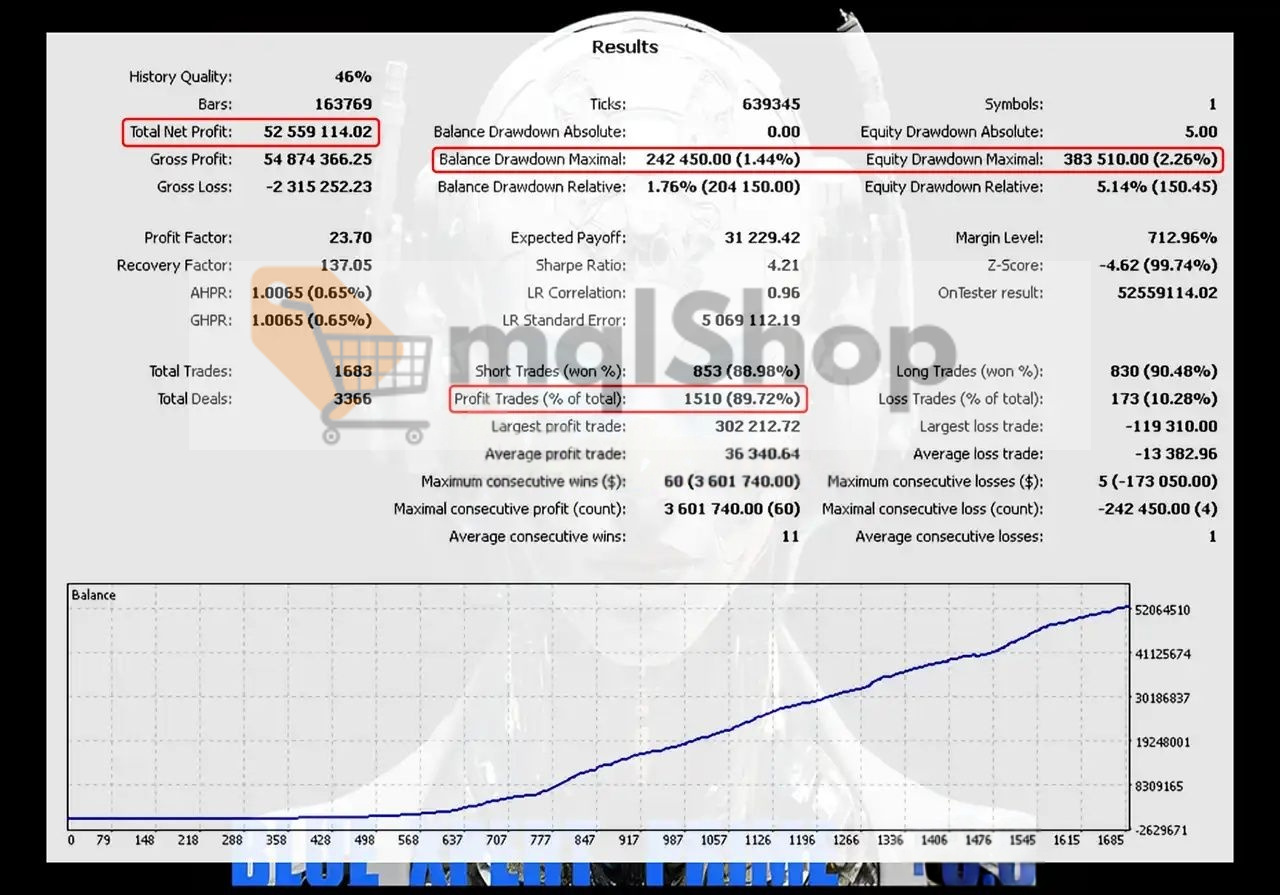

• Backtest 1: $52.6M net profit, 89.72% win rate, 2.26% max drawdown, 23.70 profit factor

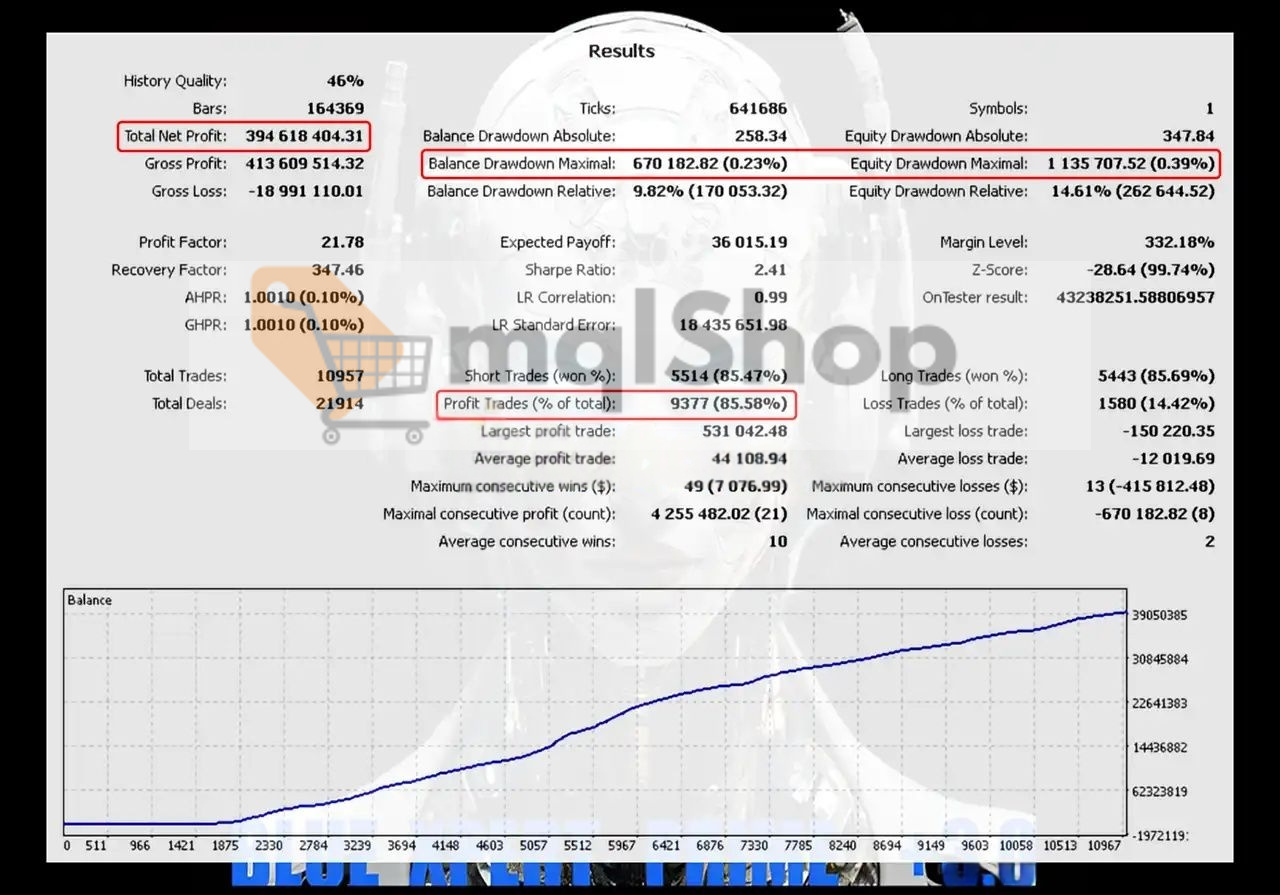

• Backtest 2: $394.6M net profit, 85.58% win rate, 0.39% max drawdown, 21.78 profit factor

• Critical Limitation: 46% history quality in both tests severely undermines data reliability – results require live verification

Is Blue Xpert Prime EA MT5 the Right Choice For You?

• Anti-Martingale Safety Design: Eliminates the account-destroying risks of grid and martingale systems through strict single-trade limits, though this conservative approach may feel slow for traders seeking frequent action and quick returns

• Predictable Risk Exposure: Fixed 500-pip stops and 0.01 lot sizing create known maximum loss per trade (~$50), providing excellent risk control but requiring patient capital to handle occasional larger percentage account impacts

• Beginner-Friendly Simplicity: No complex optimization or parameter tweaking required – set and forget operation, however the wide stop losses demand strong psychological discipline during drawdown periods

• Capital Preservation Focus: Designed for steady, controlled growth rather than explosive profits, making it ideal for risk-averse traders but potentially frustrating for those expecting rapid account multiplication

• Unverified Performance Claims: While backtest metrics appear impressive, 46% data quality requires extensive demo testing before live deployment – promises conservative gains but actual results need real-market validation

Final Verdict

Blue Xpert Prime EA MT5 excels as a conservative automated solution for risk-averse traders prioritizing capital preservation over aggressive growth. Best suited for patient investors with realistic expectations, while aggressive traders seeking frequent action should explore higher-frequency alternatives.

Blue Xpert Prime EA MT5 Download Contents:

- Link download experts:

- Blue Xpert Prime EA MT5.ex5

Be the first to review “Blue Xpert Prime EA +3.0 MT5 (original)” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

Trending Product

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.