Gold OneShot EA MT5 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

Gold OneShot EA MT5: Specialized XAUUSD robot with custom RSI reversal strategy & 365% verified gains. Built for MT5 Gold trading with risk controls.

Introducing Gold OneShot EA MT5

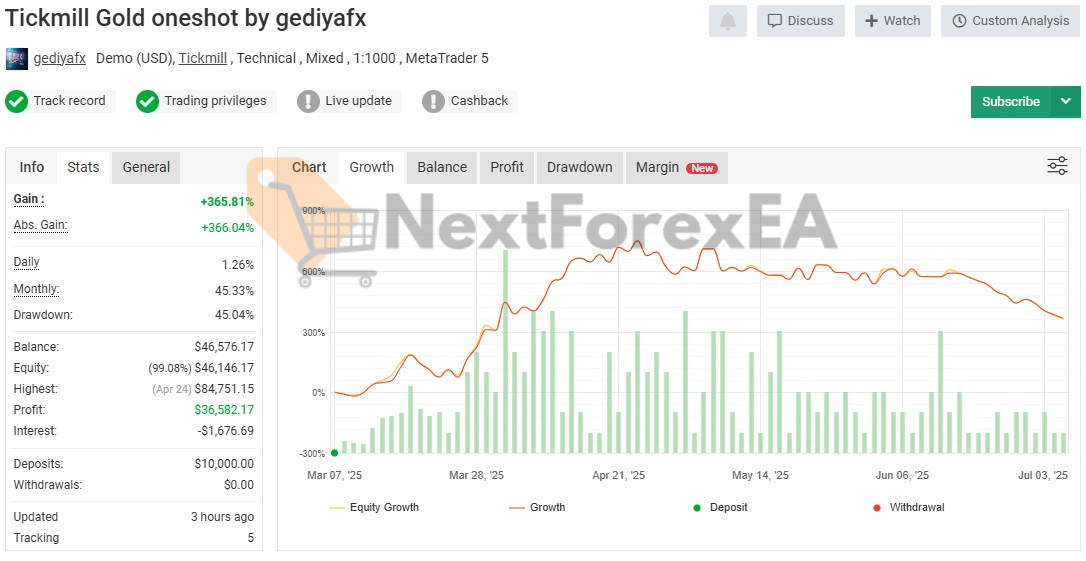

Gold OneShot EA MT5 distinguishes itself as a specialized XAUUSD expert advisor that merges custom RSI reversal methodology with protective daily loss limits, explicitly designed for prop firm challenges and high-growth trading objectives. This system showcases impressive 365.81% verified gains on live accounts while requiring tolerance for 45.04% maximum drawdown periods. Developed exclusively for MetaTrader 5, it serves experienced traders who understand the inherent risks of aggressive automated Gold trading strategies.

About the Gold OneShot EA MT5’s Author

Gediyafx contributes over 5 years of dedicated MQL5 development expertise to the automated trading community. The developer specializes in creating volatile instrument trading solutions, particularly for XAUUSD, with emphasis on risk management features that cater to both retail traders and prop firm challenge participants pursuing aggressive capital appreciation.

Key Findings

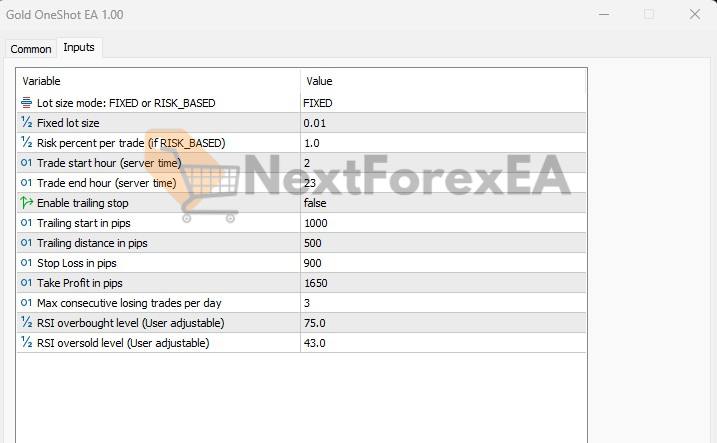

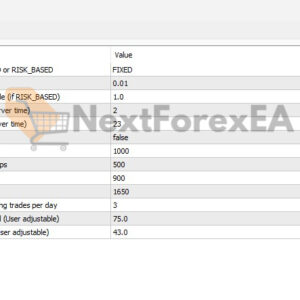

• Custom RSI Strategy: Employs specifically tuned overbought (75.0) and oversold (43.0) levels to capture Gold market exhaustion points for high-probability reversal entries

• Triple-Layer Risk Management: Combines 900-pip stop loss, 1650-pip take profit, and 3-consecutive-loss daily limit to prevent catastrophic drawdown during unfavorable conditions

• Gold-Exclusive Design: Specifically engineered for XAUUSD on M5 timeframe with optimized session timing (2-23 server hours) avoiding low-liquidity trap periods

• Flexible Capital Allocation: Supports both fixed lot and risk-percentage modes allowing traders to adjust exposure based on account size and risk tolerance levels

• Live Performance Verification: Myfxbook tracking confirms 365.81% gains with 45.33% monthly average, requiring acceptance of 45.04% maximum equity drawdown

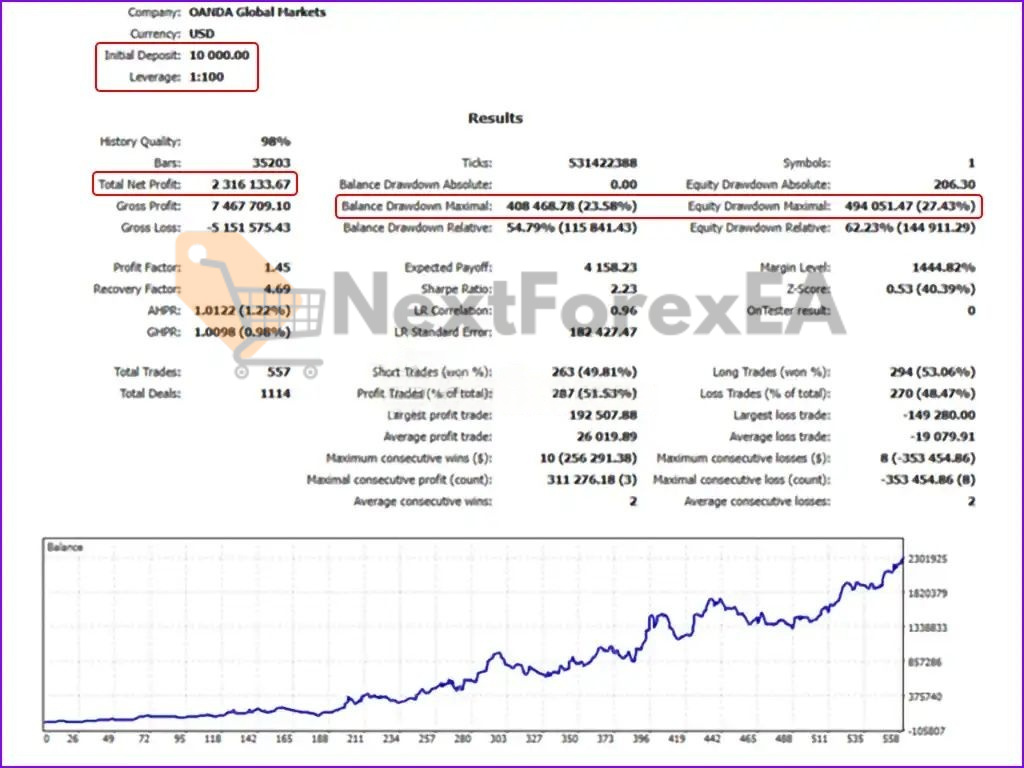

• Systematic Edge Confirmation: Historical backtest across 557 trades shows 1.45 profit factor with 23.58% maximum drawdown, indicating consistent methodology

• Trending Market Weakness: Reversal-based approach struggles during sustained Gold trends when RSI remains in extreme zones, potentially generating sequential losses

• Prop Trading Compatibility: Built-in daily limits and percentage-based sizing support prop firm compliance, though high drawdown may challenge strict evaluation criteria

Recommendations for using Gold OneShot EA MT5

• Trading Platform: MetaTrader 5 (MT5) exclusively required – ensure broker provides reliable MT5 infrastructure with competitive XAUUSD execution

• Pairs: XAUUSD only – avoid using on other instruments as strategy optimization is specifically calibrated for Gold market behavior patterns

• Supported Accounts: ECN and Standard accounts compatible – ECN preferred for superior spread conditions during high-volatility Gold trading sessions

• Timeframe: M5 charts exclusively – all entry signals and timing mechanisms are precisely calibrated for 5-minute chart analysis

• Trading Time: 2-23 server time recommended – strategically avoids low-liquidity Asian overnight periods and high-spread session transitions

• Leverage: 1:100 to 1:1000 supported range – higher leverage exponentially increases both profit potential and loss exposure; thorough margin understanding essential

• Minimum Deposit: $1,000 absolute minimum required – $5,000+ strongly advised for adequate risk management given 45% maximum drawdown characteristics

• Risk Configuration: Initialize with 1% risk per trade or lower using risk-based mode due to aggressive growth profile and substantial drawdown tolerance requirements

Review of Gold OneShot EA MT5

Gold OneShot EA MT5 successfully automates disciplined RSI reversal trading in Gold markets while eliminating emotional interference, but demands substantial drawdown tolerance and advanced risk management capabilities. Specifically designed for experienced traders comfortable with high-risk, high-reward automated strategies.

Live Trading Performance (Myfxbook):

• 365.81% total verified gains with 45.33% average monthly growth rate

• 45.04% maximum drawdown demonstrates significant equity volatility exposure

• 99.08% current equity ratio indicates active position management system

Historical Backtest Analysis:

• 557 completed trades producing 1.45 profit factor showing systematic trading edge

• 23.58% maximum drawdown in controlled historical testing environment

• $2.3 million net profit generated from $10,000 initial deposit over full testing period

Is Gold OneShot EA MT5 the Right Choice For You?

• Specialized Gold Focus: Unlike generic multi-instrument EAs, exclusively targets XAUUSD volatility patterns and market characteristics – however, this specialization eliminates portfolio diversification opportunities across other trading pairs

• Automated Discipline: Eliminates emotional trading decisions through systematic RSI reversal entries and predetermined risk parameters – though requires accepting 45% drawdown exposure during challenging market periods

• Prop Firm Alignment: Daily loss limits and percentage-based position sizing directly support prop firm evaluation criteria – but maximum drawdown levels may exceed conservative prop firm tolerance thresholds

• Performance Transparency: 365.81% verified Myfxbook results provide real-world validation beyond theoretical backtesting – while 45.04% drawdown illustrates substantial equity fluctuations accompany these returns

• Autonomous Operation: Executes trades continuously during optimal Gold sessions without requiring constant supervision – though reversal strategy may trigger multiple consecutive losses during strong trending market conditions

Final Verdict

Gold OneShot EA MT5 provides legitimate automated Gold trading with authenticated 365% performance results, but demands high drawdown tolerance and sophisticated risk management skills. Ideal for aggressive growth-oriented experienced traders; completely inappropriate for conservative investors or trading beginners.

Gold OneShot EA MT5 Download Contents:

- Link download experts:

- Gold OneShot EA MT5.ex4

- Presets:

- Gold M5.set

- Gold M5.set

Be the first to review “Gold OneShot EA MT5 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.