Dolphin EA MT4 V1.0 with Setfiles

$1,100.00 Original price was: $1,100.00.$39.99Current price is: $39.99.

Dolphin EA MT4: MyFxBook verified hedging-scalping EA with 2.18 profit factor & 609.3 pips across 234 trades. Advanced risk controls for EURUSD.

Dolphin EA MT4 Introduction

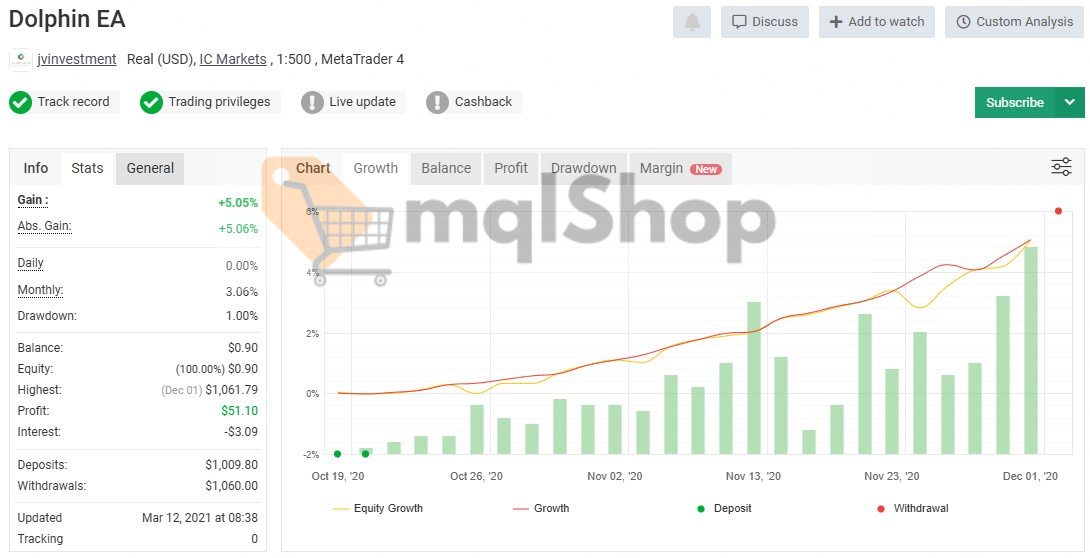

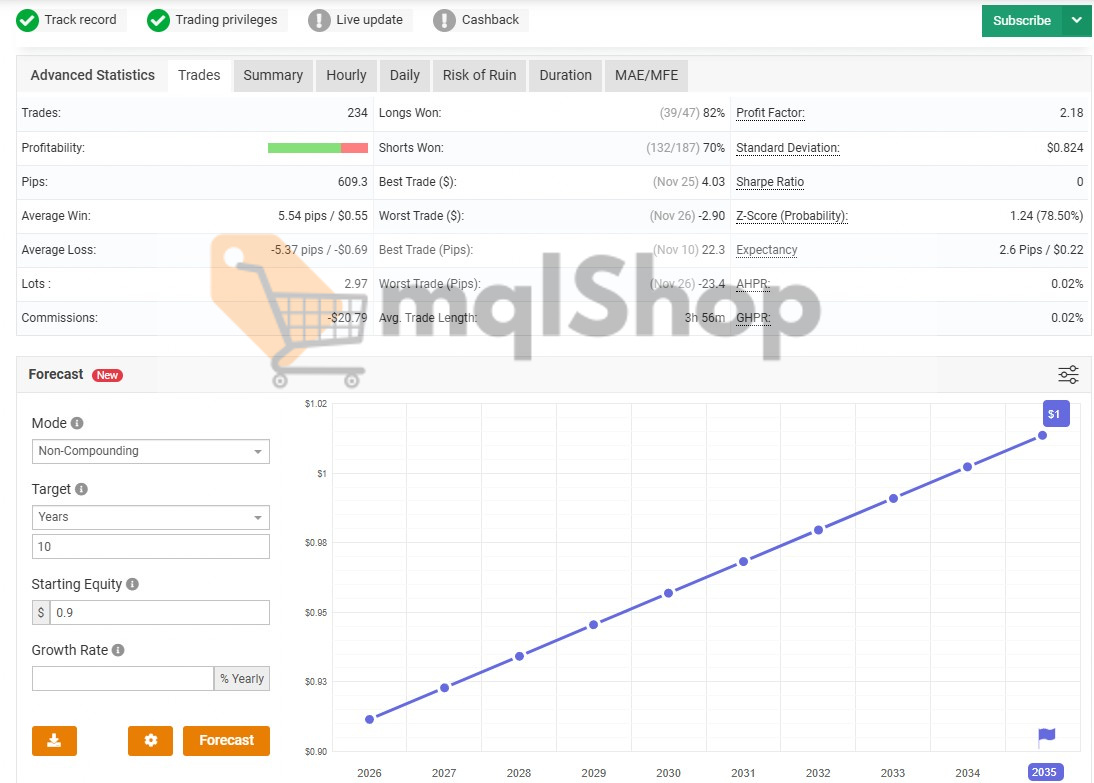

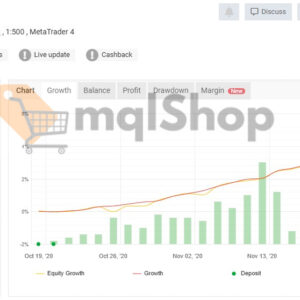

Dolphin EA MT4 leverages sophisticated hedging-scalping methodology specifically engineered for EURUSD automation, featuring adaptive volatility controls and systematic position recovery. MyFxBook verification confirms 609.3 pips accumulated across 234 trades with impressive 2.18 profit factor performance.

Key Findings

• Intelligent Hedging System: Initiates conservative scalping entries then deploys systematic counter-positions when trades exceed 500-pip adverse movement, creating balanced exposure management

• Advanced Market Adaptation: Incorporates 14-period ATR volatility measurement, 1-20 scale indicator sensitivity adjustment, and server-time filtering (8-18 hours) for optimal market condition targeting

• Systematic Recovery Protocol: Multi-tiered hedge management with configurable pip ranges, cycle limits (2 per range, 100 total), and automated profit targeting ($2.00 default) for controlled position cycling

• Comprehensive Risk Architecture: Features 30% maximum drawdown protection, 20% daily profit targets, time-based trading restrictions, and graduated lot sizing for capital preservation

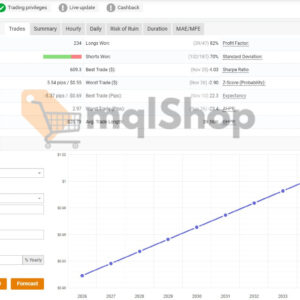

• Verified Performance Data: 3.06% monthly growth rate, 82% long position success, 70% short position success, with average $0.22 expectancy per trade over real account testing

• Strategy Risk Profile: Hedging approach enables recovery from adverse moves but can accumulate significant exposure during sustained trends; 100-cycle default exceeds conservative risk management principles

Dolphin EA MT4 Recommended Setup

• Trading Platform: MetaTrader 4 (MT4) – optimized and verified compatibility

• Currency Focus: EURUSD (primary), GBPUSD (secondary) – major pairs provide optimal execution conditions

• Account Types: ECN and Standard supported – IC Markets real account verification confirms broad broker compatibility

• Timeframe Selection: M15, M30, H1 – shorter timeframes essential for scalping entry precision and hedge timing

• Operating Hours: 8:00-18:00 server time – strategic avoidance of overnight risks and low liquidity periods

• Leverage Configuration: Up to 1:500 tested – remember higher leverage proportionally increases both profit potential and loss risk

• Minimum Investment: $500-1000 recommended starting capital – adequate balance crucial for hedge cycle management without margin pressure

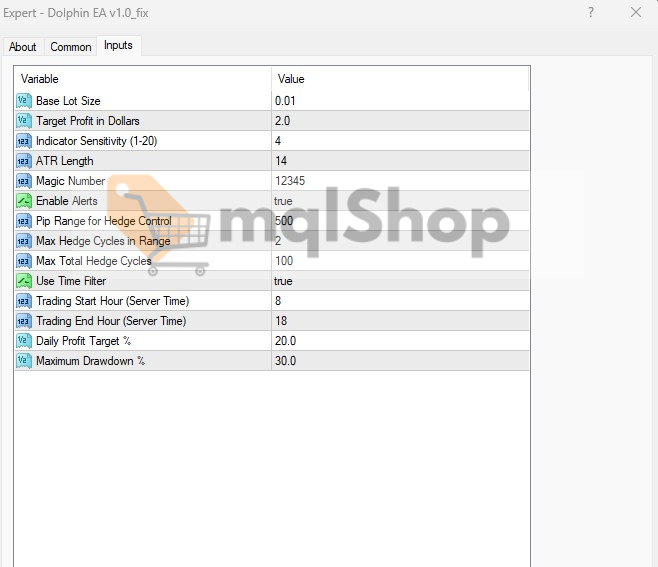

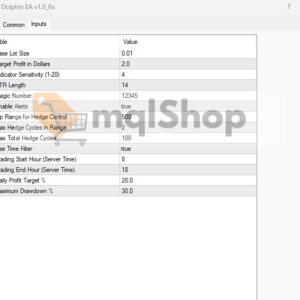

Quick-Start Parameter Guide

Essential Risk Controls

• Base Lot Size (0.01): Conservative starting position – ideal for initial testing and gradual scaling

• Maximum Drawdown % (30.0): Account protection ceiling – consider reducing to 15-20% for enhanced safety

• Daily Profit Target % (20.0): Trading halt mechanism – unrealistic default, recommend 2-5% for practical implementation

Hedge Management

• Pip Range for Hedge Control (500): Recovery trigger distance – fundamental parameter for risk timing

• Max Hedge Cycles in Range (2): Position density control – limits concentration at specific price levels

• Max Total Hedge Cycles (100): Overall hedge ceiling – extremely high default, recommend 15-30 maximum

Strategy Fine-Tuning

• Indicator Sensitivity (4): Entry signal responsiveness – moderate default, increase for more frequent trading

• ATR Length (14): Volatility calculation period – standard setting for market condition assessment

• Target Profit in Dollars (2.0): Cycle closure objective – scale proportionally with account size

Review of Dolphin EA MT4

Dolphin EA presents well-structured hedging approach with documented performance but demands careful parameter optimization to prevent over-exposure. Effectively eliminates emotional trading decisions while requiring strategic understanding of position accumulation dynamics. Best suited for methodical traders comfortable with systematic recovery concepts.

MyFxBook Verification Summary:

• 234 completed trades generating 5.05% total account growth

• Consistent performance: 2.18 profit factor with 75% overall success rate

• Risk management: 1.06% maximum drawdown during 3-month verification period

• Trade efficiency: Average 3 hours 56 minutes duration with positive $0.22 expectancy

Is Dolphin EA MT4 the Right Choice For You?

• Documented Real Performance: MyFxBook verification provides concrete evidence of system effectiveness, though 3-month timeframe requires cautious extrapolation for long-term expectations

• Systematic Position Management: Automated hedging protocol removes emotional interference and provides structured drawdown recovery, but requires understanding of exposure accumulation during adverse market movements

• Comprehensive Market Coverage: 10-hour daily trading window with volatility-based adaptations captures diverse market conditions, while time filtering avoids high-risk news and low-liquidity periods

• Scalable Risk Framework: Conservative base lot sizing enables safe testing with gradual capital allocation increases, though hedge cycling can rapidly escalate position sizes beyond initial comfort levels

• Professional Implementation: Detailed parameter controls and verified broker compatibility demonstrate quality development, while proprietary entry logic limits complete strategy transparency for advanced users

Final Verdict

Dolphin EA MT4 delivers professional-grade hedging automation with verified conservative gains, ideally suited for systematic traders seeking emotion-free EURUSD scalping with structured risk management. Requires parameter adjustment expertise and hedge strategy comfort for optimal implementation.

Dolphin EA MT4 Download Contents:

- Link download experts:

- Dolphin EA MT4.ex4

- Presets

Be the first to review “Dolphin EA MT4 V1.0 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

SOURCE CODE

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.