WinX EA MT4 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

WinX EA MT4 combines AI-enhanced trend analysis with hedge scalping on M15 timeframe. Features automated risk management and 24/7 trading capability.

WinX EA MT4 Introduction

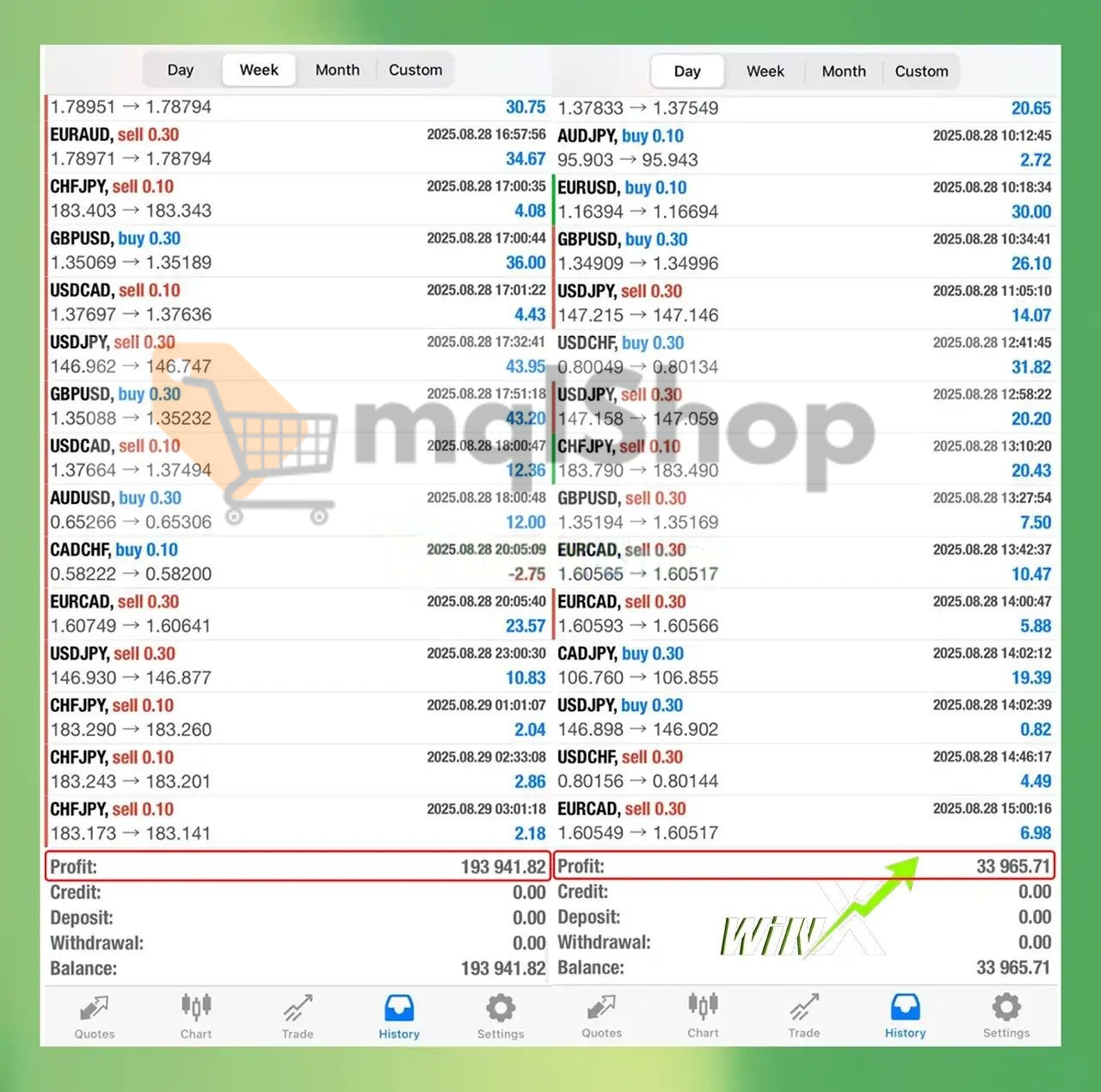

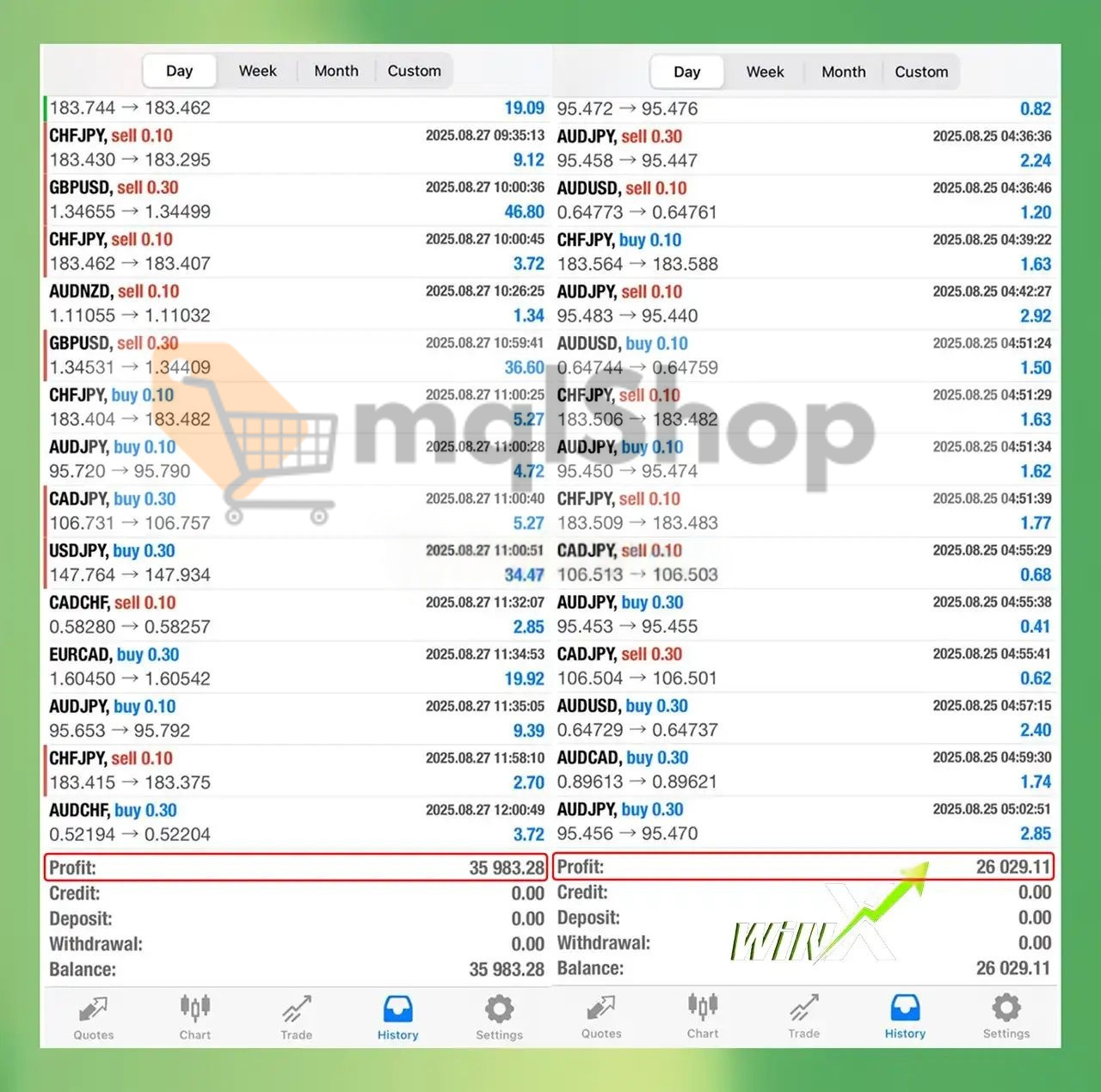

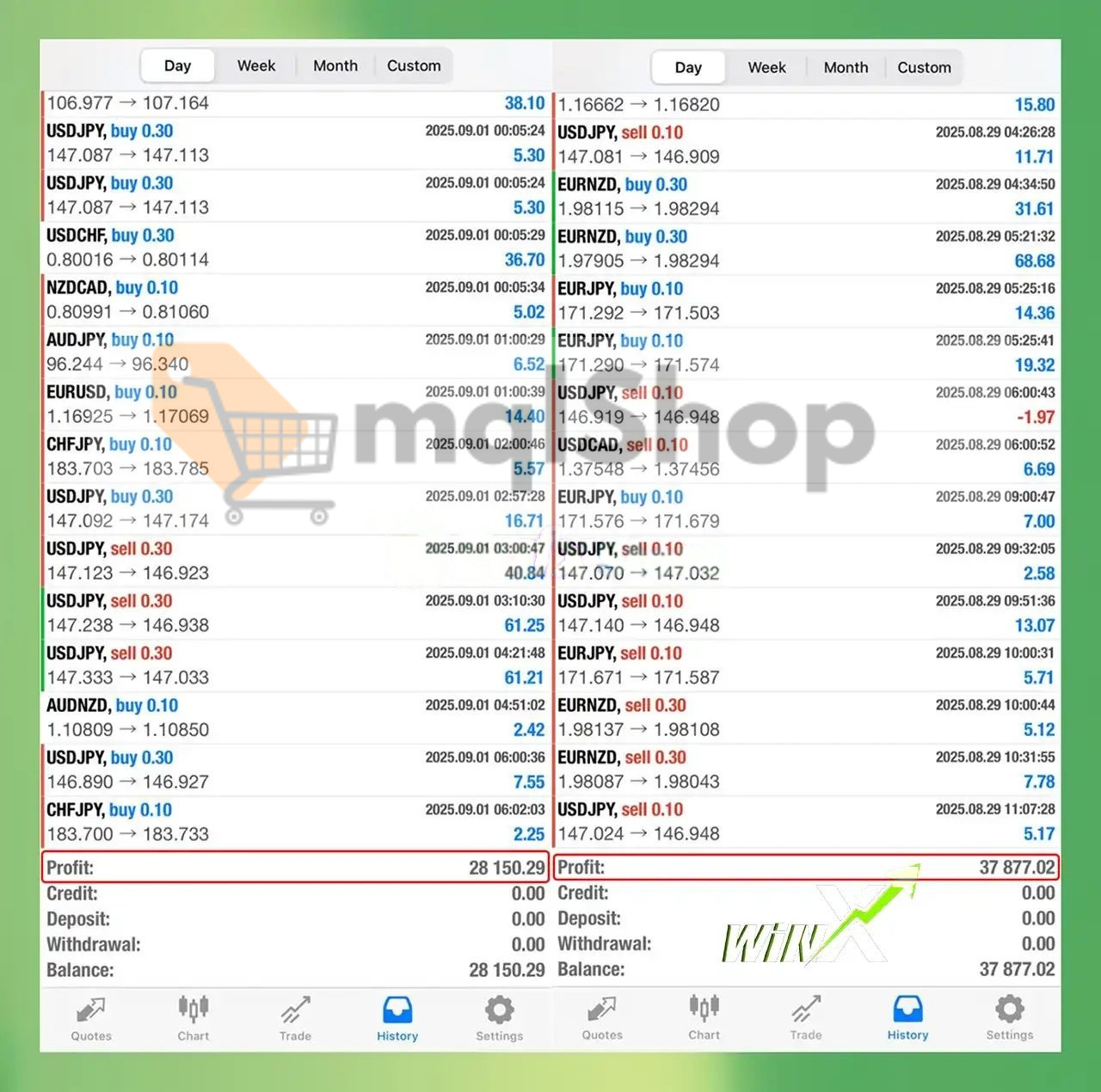

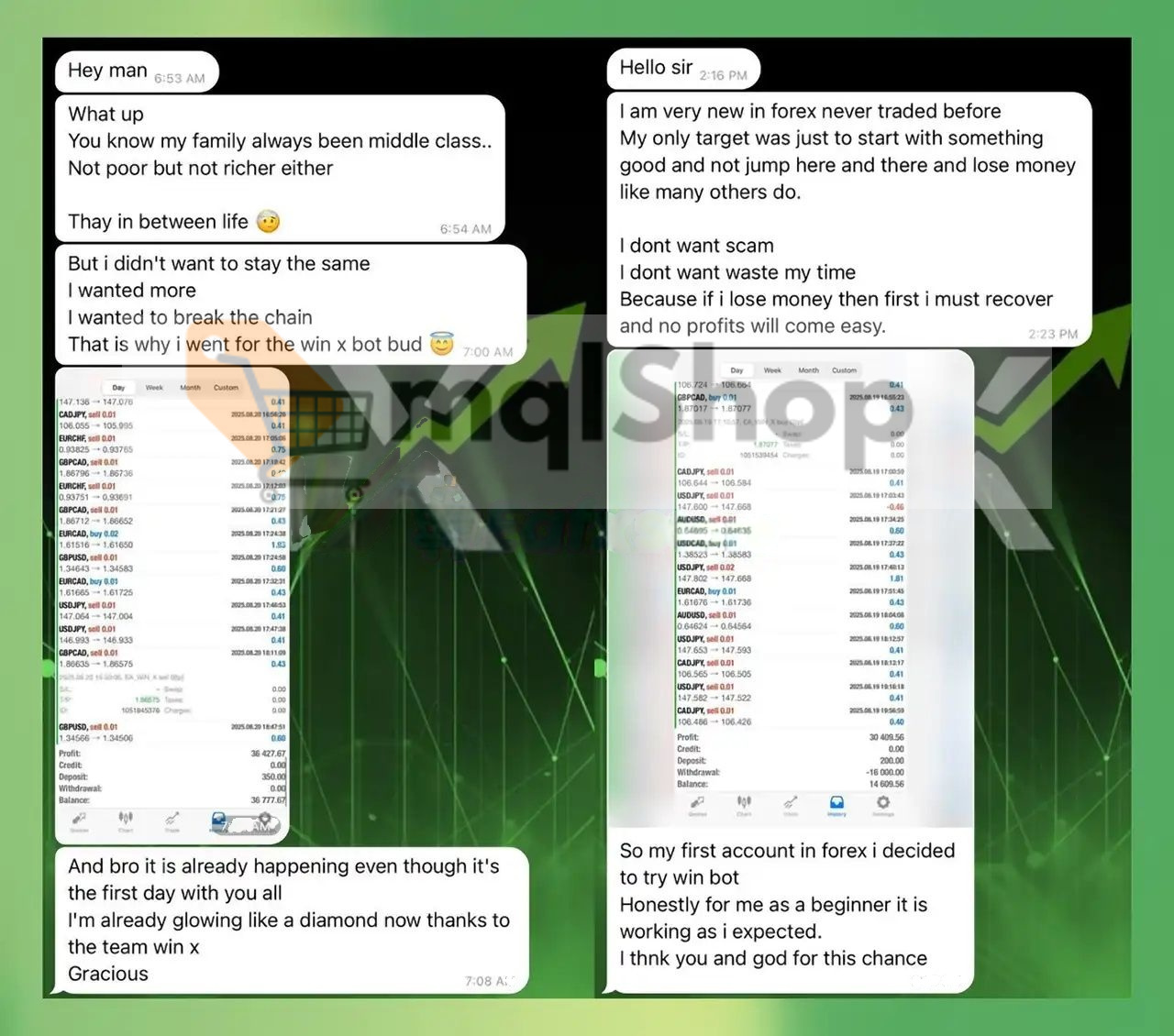

WinX EA MT4 positions itself as an AI-enhanced hedge scalping system designed to capitalize on M15 timeframe opportunities across major currency pairs. The vendor claims extraordinary weekly profits exceeding $193,000, though these results lack third-party verification and contain concerning inconsistencies including future-dated timestamps.

Key Findings

• Core Strategy: Combines trend-following scalping with hedging mechanisms, utilizing AI integration for market adaptation and dynamic entry/exit timing on 15-minute charts

• Algorithm Components: Employs trailing stop-loss and take-profit systems, dynamic lot sizing based on account equity, and automated risk management controls designed to trade with market momentum rather than against it

• Trading Logic: The EA identifies short-term trend opportunities while maintaining hedge positions as risk mitigation, automatically adjusting trade sizes and implementing trailing mechanisms to lock in profits as positions move favorably

• Key Benefits: Offers 24/7 automated trading, customizable risk parameters, pre-optimized settings file, and comprehensive stop-loss/take-profit management without requiring constant manual oversight

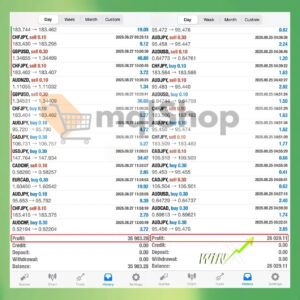

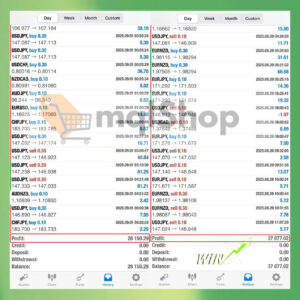

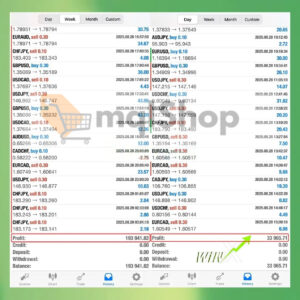

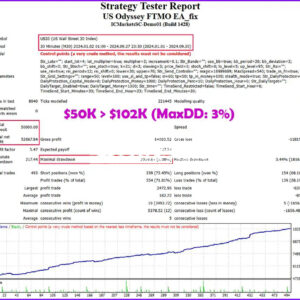

• Performance Claims: Vendor displays profits ranging from $26,000 to $193,000 weekly across multiple accounts, but critical red flags include zero deposits/withdrawals shown, future-dated trades (2025 timestamps), and complete lack of verified third-party tracking

• Risk Disclosure: Hedging strategies can create significant margin requirements and potential drawdown scenarios, while scalping performance heavily depends on low-spread execution and stable broker conditions

WinX EA MT4 Recommended Setup

• Trading Platform: MetaTrader 4 (MT4) exclusively

• Pairs: EURUSD, GBPUSD, USDJPY, EURCHF, AUDJPY, USDCHF, EURGBP – note that vendor screenshots show trading on additional pairs like XAUUSD not in official recommendations

• Supported Accounts: ECN accounts strongly recommended for optimal spread conditions and execution speed

• Timeframe: M15 (15-minute charts) as primary operational timeframe

• Trading Time: 24/7 operation capability, though performance may vary during low-liquidity periods

• Leverage: Vendor suggests minimum ratios but higher leverage significantly amplifies both profit potential and loss exposure

• Minimum Deposit: $500 according to included settings file, though higher balances advisable for safer lot sizing and drawdown management

Quick-Start Parameter Guide

Risk Management Parameters:

• Lot Size Control: Dynamic sizing adjusts to account balance automatically, with manual override options available for conservative traders

• Stop Loss Settings: Automated SL placement with trailing functionality to protect capital while allowing profit maximization

• Maximum Spread Filter: Prevents trades during high-spread conditions that could erode scalping profits

Trade Entry Controls:

• Trend Confirmation: AI-enhanced signals determine optimal entry timing based on market momentum analysis

• Hedge Activation: Secondary positions triggered under specific market conditions as risk mitigation tool

Profit Management:

• Take Profit Trailing: Dynamic TP levels follow price movement to capture extended trends

• Position Sizing: Scales trade volume based on account equity and risk tolerance settings

Review of WinX EA MT4

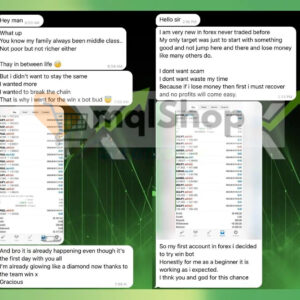

WinX EA presents an intriguing hedge-scalping concept with AI integration, but the unverified performance claims featuring impossible future dates and zero account activity severely undermine credibility. The strategy logic appears sound for experienced traders, yet the vendor’s presentation raises significant trust concerns that potential users must carefully evaluate before commitment.

Performance Snapshots Analysis:

• Weekly Profit Claims: $193,941 displayed with zero deposits/withdrawals – red flag indicating potential fabricated results

• Multiple Account Results: Profits ranging $26K-$37K across different periods – concerning lack of verified tracking or account growth patterns

• Trade Execution: Shows activity on unauthorized pairs beyond official recommendations – suggests either modified settings or questionable documentation

Is WinX EA MT4 the Right Choice For You?

• Advanced Strategy Appeal: Combines hedge protection with scalping precision for potentially smoother equity curves – requires understanding of margin requirements and hedging risks that beginners often underestimate

• Automated Risk Management: Comprehensive SL/TP trailing systems reduce emotional trading decisions – effectiveness depends entirely on proper broker selection and stable VPS environment

• AI-Enhanced Adaptation: Claims intelligent market analysis for improved entry timing – “AI” integration remains unverified and may be marketing terminology rather than genuine machine learning

• Customization Flexibility: Allows risk parameter adjustment for different trading styles – improper settings modifications can dramatically alter risk profile and potentially void any optimization

• Performance Verification Gap: Extraordinary profit claims lack credible third-party validation – demands extensive demo testing and realistic expectation management before live deployment

Final Verdict

WinX EA MT4 offers a theoretically sound hedge-scalping approach with comprehensive automation, but questionable performance claims and verification issues require extreme caution. Best suited for experienced traders willing to conduct thorough testing; beginners should seek alternatives with verified track records and transparent documentation.

WinX EA MT4 Download Contents:

- Link download experts:

- WinX EA MT4 .ex4

- Presets:

- Mindeposit_$500.set

Be the first to review “WinX EA MT4 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

SOURCE CODE

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.