ESCOBAR EA MT5 V1.0 with Setfiles

$799.00 Original price was: $799.00.$39.99Current price is: $39.99.

ESCOBAR EA MT5: Advanced 10-strategy forex robot delivers 4+ profit factors with built-in equity protection. MT5-optimized for prop firms. Professional automation.

ESCOBAR EA Introduction

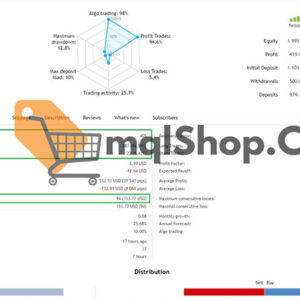

ESCOBAR EA MT5 delivers a comprehensive ten-strategy trading system engineered for funded account success, featuring advanced equity protection and intelligent market filtering capabilities. Extensive backtesting reveals consistent profit factors above 4.0 across all account sizes, though maximum equity drawdowns reaching 38.55% require disciplined capital management approaches.

Key Findings

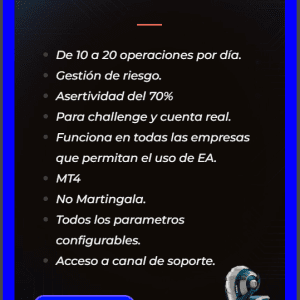

• Advanced Multi-Strategy Framework: Ten simultaneous trading algorithms incorporate trend-following, mean-reversion, and breakout methodologies, providing diversified market approach while managing cross-strategy risk exposure

• Comprehensive Technical Analysis: Combines ZigZag pattern recognition, RSI momentum analysis, and T3 Moving Average confirmation with customizable grid logic for precise market entry and exit timing

• Institutional Risk Controls: Automated equity protection system halts trading at predetermined loss levels, while smart news filtering avoids high-volatility periods that could compromise capital preservation goals

• Performance Validation: Backtests demonstrate profit factors consistently between 3.71-4.25 across account sizes from $500-$5,000, with recovery factors averaging 2.0+, though equity drawdowns can exceed 35% during adverse conditions

• Prop Firm Compliance: Built-in protective features specifically address funded account requirements, emphasizing capital preservation through systematic risk management rather than aggressive profit pursuit

• Multi-Strategy Risk: Simultaneous operation of ten algorithms can create periods where multiple strategies experience drawdowns concurrently, requiring adequate capital reserves and disciplined risk management

ESCOBAR EA Recommended Setup

• Trading Platform: MetaTrader 5 (MT5) – exclusively optimized for MT5 environment

• Pairs: EURUSD (primary), USDJPY, USDCHF, USDCAD, GBPJPY, CADJPY, CHFJPY – begin with EURUSD for validated performance

• Supported Accounts: ECN accounts preferred for execution quality, Standard accounts compatible – verify spread competitiveness for multi-strategy operations

• Timeframe: H1 (1-hour charts) – primary optimization and testing timeframe

• Trading Time: Continuous 24/5 automated operation – smart news filter manages volatile periods

• Leverage: 1:100 recommended – higher leverage significantly amplifies both profit potential and loss exposure across all strategies

• Minimum Deposit: $1,000 minimum viable – $2,000+ strongly recommended for optimal risk distribution across ten concurrent trading strategies

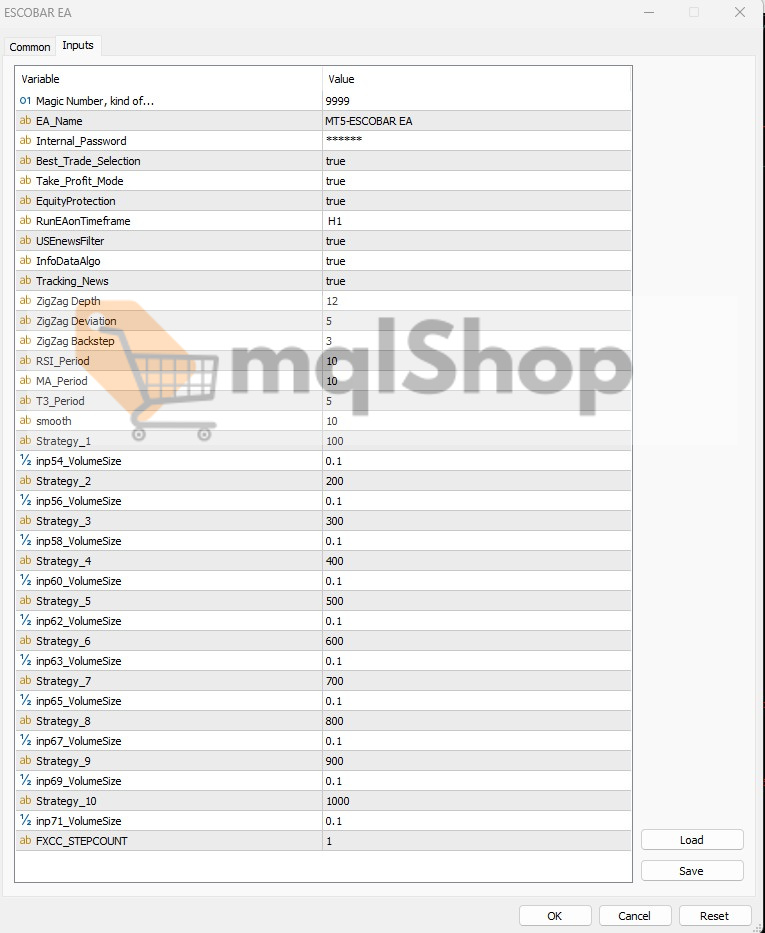

Quick-Start Parameter Guide

Essential Protection Settings

• EquityProtection: true – Automatically halts trading at predefined equity loss threshold

• USERnewsFilter: true – Pauses operations during high-impact economic releases

• BestTradeSelection: true – Filters for only highest-probability trade setups

Strategy Volume Control

• inp54VolumeSize: 0.1 – Strategy 1 position sizing (adjust with extreme caution)

• inp56VolumeSize: 0.1 – Strategy 2 lot allocation

• TakeProfitMode: true – Activates systematic profit-taking mechanism

Technical Indicator Settings

• ZigZagDepth: 12 – Market structure identification sensitivity

• RSIPeriod: 14 – Momentum analysis timeframe

• MA_Period: 10 – Moving average confirmation period

Critical Note: Volume modifications affect all ten strategies simultaneously, creating exponential risk increase.

Review of ESCOBAR EA

ESCOBAR EA combines sophisticated multi-strategy automation with professional risk management, delivering consistent 4+ profit factors while requiring disciplined management of substantial equity fluctuations inherent to ten-strategy operations.

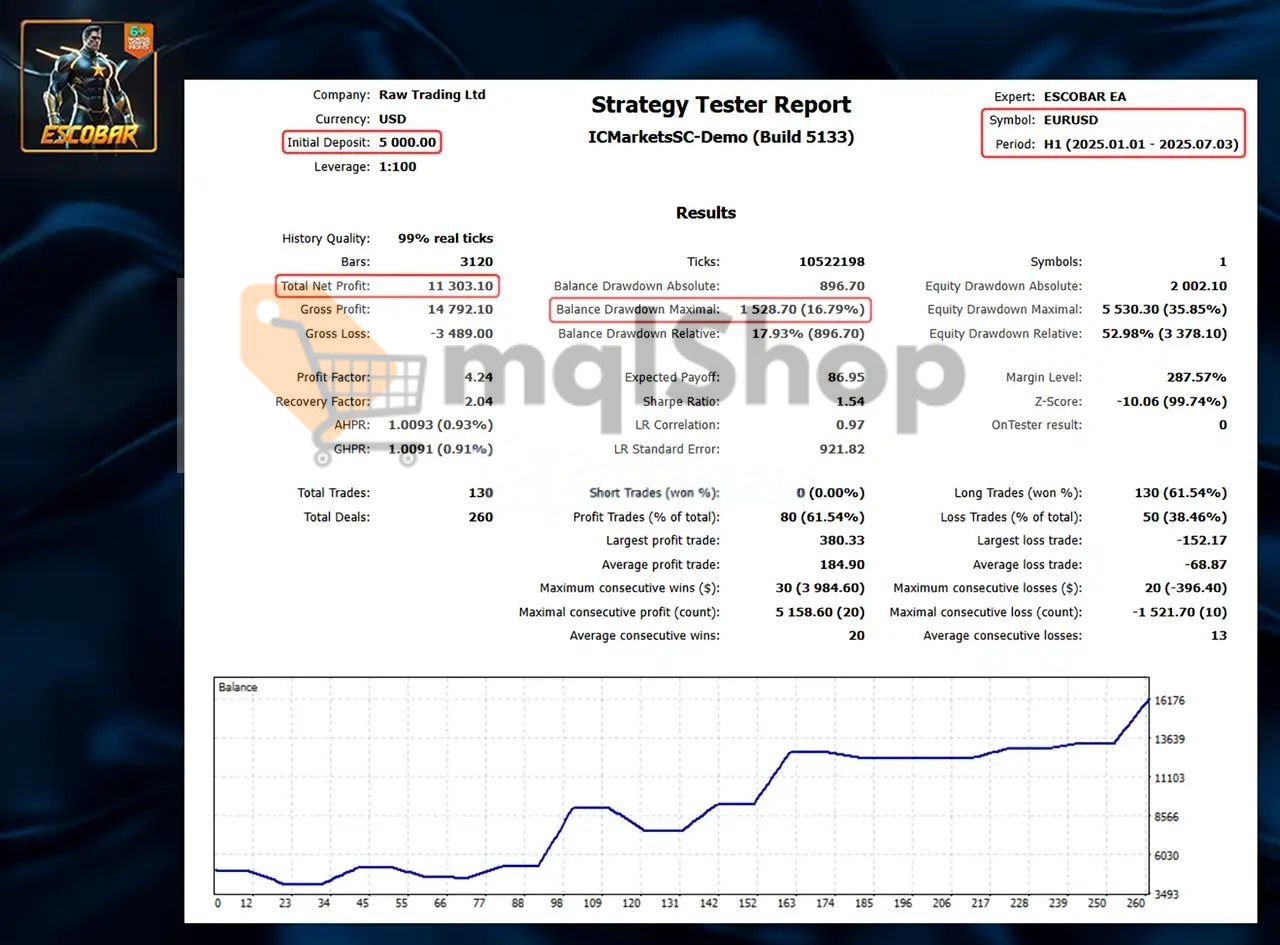

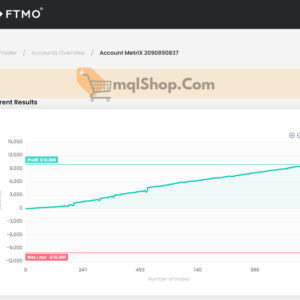

Comprehensive Backtest Results:

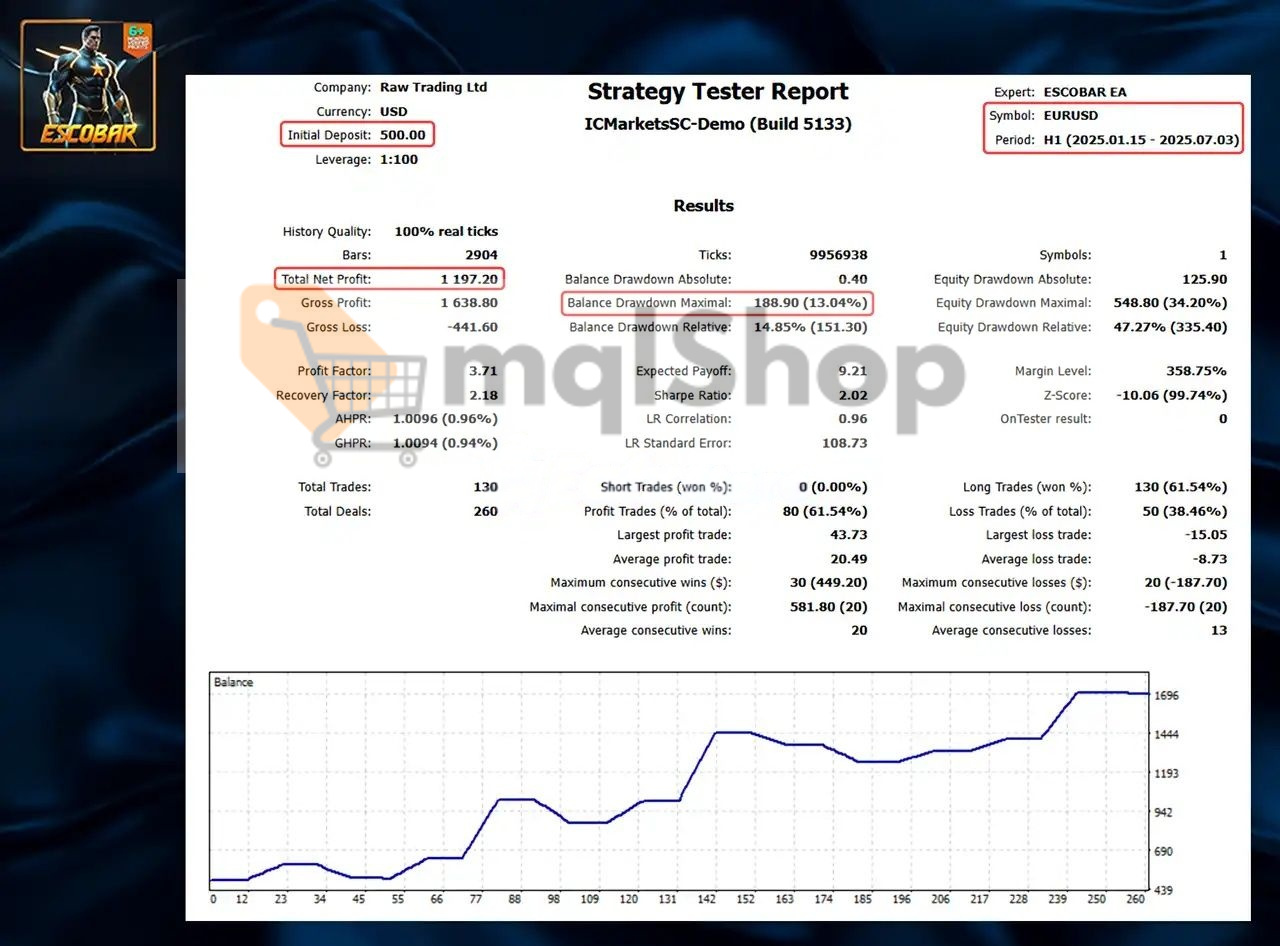

• $500 Account: Achieved $1,197 net profit (239% return) with 13.04% maximum balance drawdown – proves viability for smaller capital allocations with controlled risk exposure

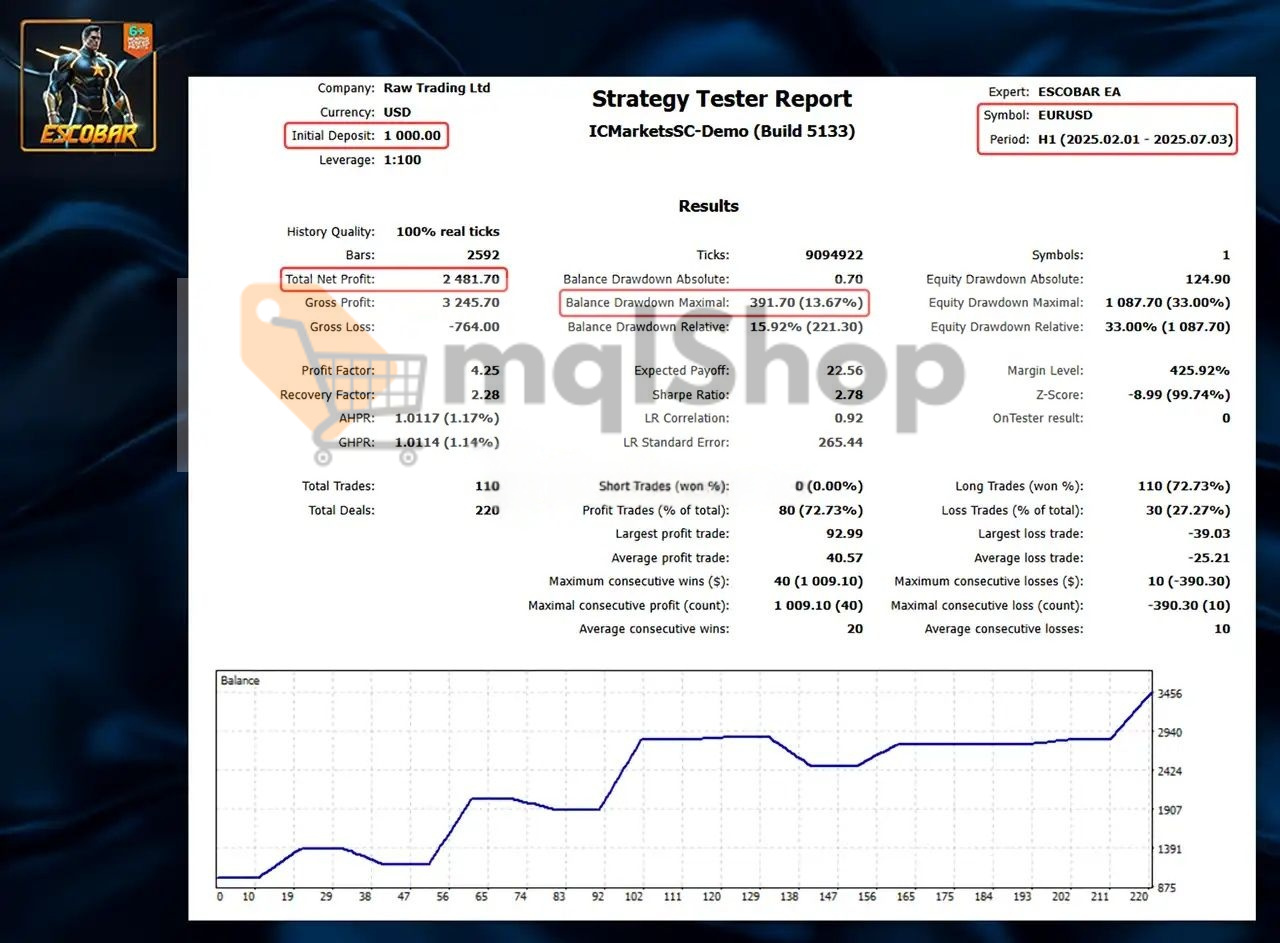

• $1,000 Portfolio: Generated $2,482 profit with 4.25 profit factor over 5.5-month period, demonstrating consistent edge despite periods of equity stress

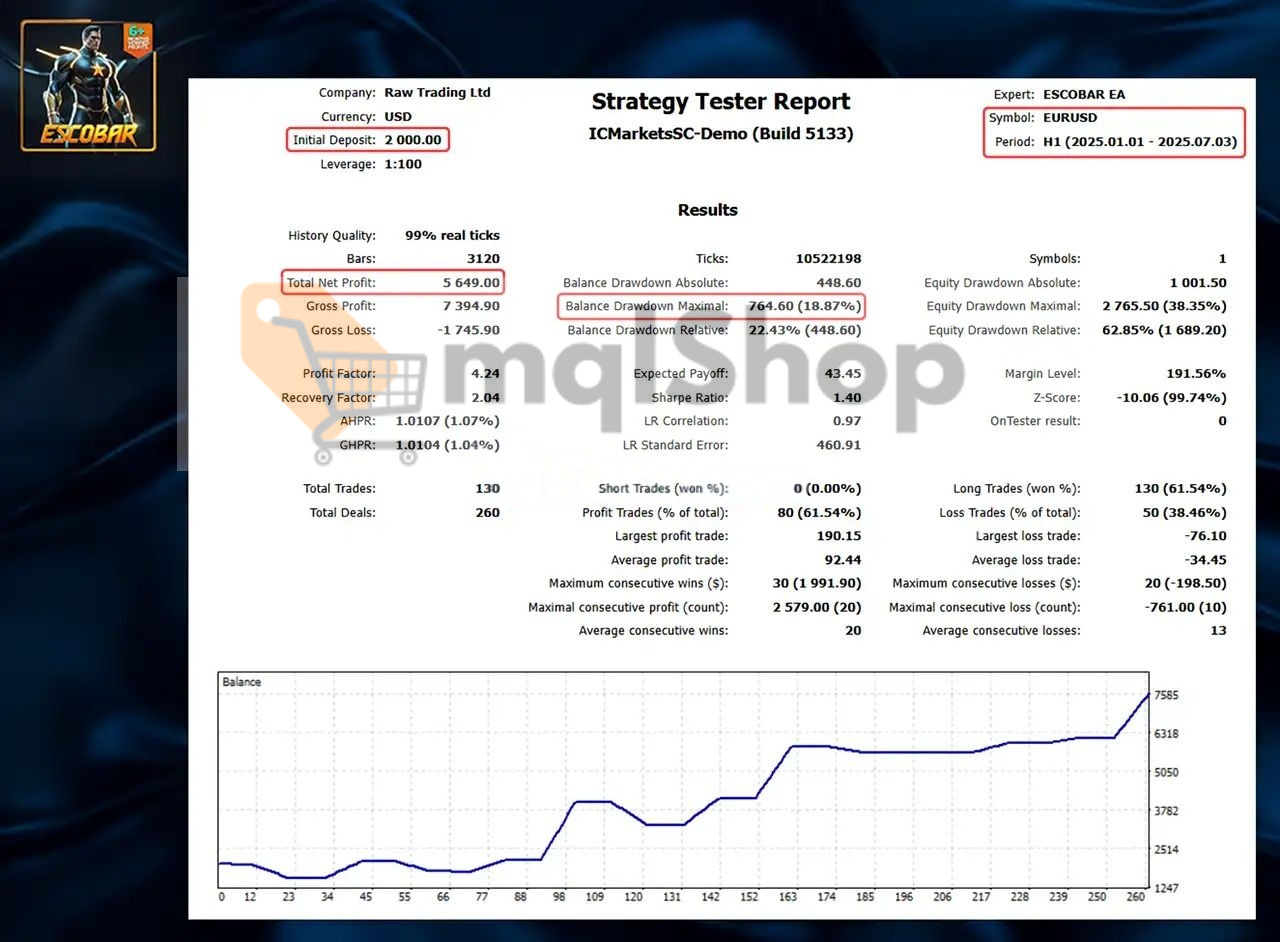

• $2,000 Capital: Produced $5,649 profit (282% ROI) with 4.24 profit factor, though 38.55% equity drawdown illustrates the intensive nature of simultaneous multi-strategy operations

• $5,000 Account: Delivered $11,303 profit (226% return) with improved 17.93% relative drawdown – shows enhanced stability and risk management with larger capital base

Is ESCOBAR EA the Right Choice For You?

• Comprehensive Strategy Diversification: Ten independent algorithms reduce reliance on single trading approaches and market conditions, but require understanding that multiple strategies can face simultaneous challenges during adverse market phases

• Professional-Grade Risk Management: Equity protection and news filtering systems rival institutional trading platforms, though users must maintain trust in the system during normal drawdown cycles without premature intervention

• Funded Account Specialization: Built-in compliance features specifically address prop firm requirements and capital preservation mandates, but potential for significant drawdowns requires conservative position sizing relative to account equity

• Systematic Performance Edge: Profit factors consistently above 4.0 across multiple testing scenarios indicate robust market advantage, balanced against maximum drawdowns that demand substantial capital buffers and appropriate risk tolerance

• Complete Trading Automation: 24/5 operation with sophisticated decision-making eliminates emotional trading while requiring disciplined adherence to system parameters during inevitable periods of temporary equity reduction

Final Verdict

ESCOBAR EA provides professional multi-strategy automation with documented systematic advantages, best suited for funded account traders and experienced automated trading specialists who can effectively manage significant equity volatility for superior long-term performance.

ESCOBAR EA MT5 Download Contents:

- Link download experts:

- ESCOBAR EA MT5 .ex4

- Presets:

- 200_EURUSD.set

- 500_EURUSD.set

- 1000_EURUSD_High Risk.set

- 1000_EURUSD_Medium Risk.set

- 1000_EURUSD_Low Risk.set

- 2000_EURUSD_High Risk.set

- 2000_EURUSD_Medium Risk.set

- 2000_EURUSD_Low Risk.set

- 5000_EURUSD_High Risk.set

- 5000_EURUSD_Medium Risk.set

- 5000_EURUSD_Low Risk.set

Be the first to review “ESCOBAR EA MT5 V1.0 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.